BTC Price Prediction: $135K in Sight as Institutional Adoption Meets Technical Breakout

#BTC

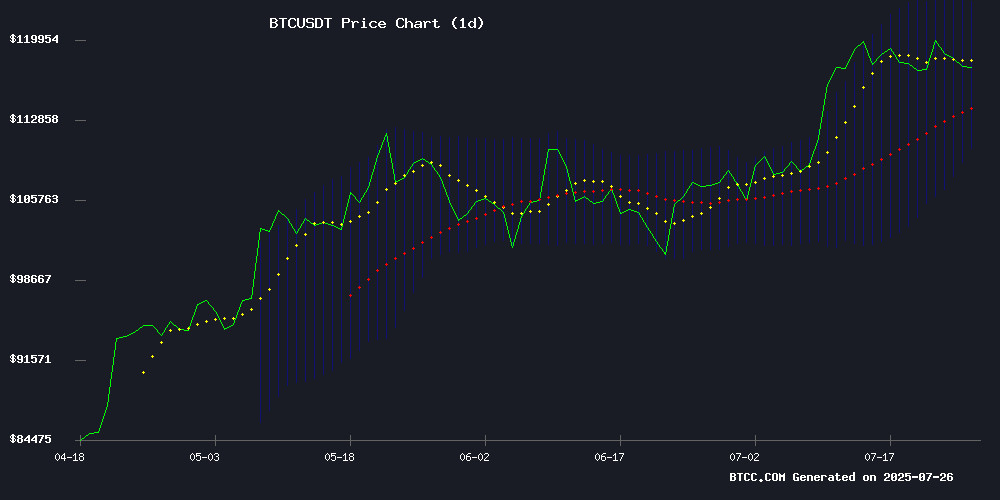

- Technical Breakout: BTC price sustains above 20MA with MACD showing early reversal signs

- Institutional Validation: $9B OTC deals and corporate treasury allocations signal maturation

- Macro Tailwinds: Potential gold market cap displacement and regulatory clarity boosting adoption

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

BTC currently trades at, firmly above its 20-day moving average ($116,820), signaling bullish momentum. The MACD histogram shows narrowing bearish divergence (-3,370 vs -4,813), while price hugs the upper Bollinger Band ($123,331) – a classic uptrend pattern.notes BTCC's Sophia.

Institutional Winds Fill Bitcoin's Sails

Galaxy Digital's $9B whale transaction and corporate treasury expansions (like Smarter Web's £19.6M purchase) underscore growing institutional adoption.observes Sophia. Tether's mining OS initiative could further decentralize network hashrate, while Citi's $135K-$199K targets align with our technical outlook. Regulatory shifts may create tactical buying opportunities during this summer consolidation.

Factors Influencing BTC’s Price

Senator Sparks Bitcoin Debate with Bold Predictions

United States Senator Cynthia Lummis has positioned Bitcoin as a potential safe haven and catalyst for long-term financial prosperity. Her remarks come amid growing skepticism toward traditional financial systems, with Bitcoin emerging as a decentralized alternative to the U.S. dollar.

Lummis emphasized Bitcoin's immunity to inflationary monetary policies, citing its fixed supply and independence from central banks. The cryptocurrency's role in empowering individuals during economic uncertainty was a recurring theme, alongside its potential to reshape investment strategies.

The senator's comments highlight a broader institutional recognition of crypto assets. As traditional markets face volatility, Bitcoin's properties as a non-sovereign store of value are gaining political attention.

Tether to Launch Open-Source Mining OS for Bitcoin Decentralization

Tether's forthcoming Mining Operating System (MOS), slated for open-source release by late 2025, marks a strategic push to democratize Bitcoin mining infrastructure. The modular platform accommodates everything from hobbyist rigs to industrial-scale farms, dismantling proprietary vendor dependencies through peer-to-peer IoT architecture.

Hardware-agnostic design principles allow seamless integration across air-cooled, immersion, and hybrid setups. Real-time optimization will be enabled via QVAC, Tether's proprietary AI engine—a move that could recalibrate mining efficiency benchmarks globally.

Smarter Web Company Expands Bitcoin Treasury with £19.6M Purchase, Nearing 2,000 BTC

The Smarter Web Company has fortified its Bitcoin-centric treasury strategy with a £19.6 million acquisition of 225 BTC, bringing its total holdings to 1,825 BTC. Executed at an average price of £87,096 per coin, the purchase underscores the London-listed firm's commitment to its 10-year Bitcoin accumulation plan initiated in April 2025.

With zero debt and £1 million in remaining cash reserves, the company signals readiness for further Bitcoin acquisitions. Its treasury now holds £146.85 million in BTC at an average cost basis of £80,466 per coin—a position yielding a 43,787% year-to-date return as Bitcoin assumes center stage in corporate capital allocation.

Galaxy Digital Facilitates $9B Bitcoin Transaction as BTC Holds Above $117K

Galaxy Digital executed a landmark $9 billion Bitcoin transaction, transferring over 80,000 BTC on behalf of a Satoshi-era holder. The sale, tied to estate planning, underscores institutional confidence in managing large-scale crypto exits without market disruption.

Bitcoin's price stability above $117,000 demonstrates remarkable liquidity despite the volume. The trade highlights Galaxy Digital's growing influence in facilitating high-value crypto transactions while maintaining minimal slippage.

Early Bitcoin holders appear increasingly active in strategic wealth management, signaling maturation in long-term asset stewardship. The market absorbed the transaction with technical strength, reinforcing bullish sentiment around BTC's price resilience.

Bitcoin Rebounds as Galaxy Completes $9B BTC Sale from Satoshi-Era Whale

Bitcoin recovered from an overnight dip below $115,000, stabilizing near $117,200 despite a 1.2% daily decline. The volatility coincided with Galaxy Digital's execution of a historic $9 billion BTC sale on behalf of a long-dormant whale wallet. Analysts suggest the selling pressure may now be exhausted, paving the way for renewed upside.

John Glover of Ledn predicts a local bottom forming this weekend before a potential rally toward $132,000, citing Elliott Wave patterns. The transaction marks a watershed moment in Bitcoin's institutional adoption story, with Galaxy framing it as estate planning rather than bearish speculation.

Bitcoin Market Stabilizes After Whale's $3.5 Billion Sale via Galaxy Digital

Investors exhaled as a decade-old Bitcoin reserve finally cleared the market. The movement of 80,000 BTC—48,000 of which flowed through Galaxy Digital in a single $3.5 billion transaction—initially sparked fears of a price collapse. Yet the measured dispersal prevented major disruption, leaving BTC hovering near all-time highs.

"Selling $10 billion in days should crater any asset," remarked trader Steven. "That we're still flirting with ATHs shows this market's resilience." The event marks a key psychological threshold: the absorption of one of crypto's last major overhangs without derailing the bull run.

While the whale's motives remain opaque, the resolution coincides with macro tailwinds. Upcoming US-EU trade negotiations could inject fresh momentum into risk assets. For now, traders celebrate a market that digested historic supply without blinking.

Bitcoin Surges as Institutional Adoption Shifts Market Dynamics

Bitcoin's historical four-year cycle, once a reliable predictor of market peaks, appears to be fading as institutional adoption reshapes market dynamics. On-chain analyst Ki Young Ju, CEO of CryptoQuant, initially predicted the end of the bull market but later retracted his statement. Now, he asserts the cryptocurrency cycle theory is obsolete, citing a shift in whale behavior—old whales are selling to new long-term holders rather than retail investors.

The traditional model of buying during whale accumulation and selling during retail influx no longer holds. Bitcoin's evolution into a mainstream asset, comparable to gold or silver, has rendered classical cycle interpretations ineffective. This paradigm shift underscores the growing influence of institutional players in the crypto market.

Bitcoin’s Summer Slowdown Presents Potential Buying Opportunity Amid Regulatory Shifts

Bitcoin appears to be entering a seasonal summer correction, with institutional inflows slowing after the closure of the corporate buying window. Matrixport's July 25 report notes this aligns with historical patterns of reduced trading activity and heightened volatility during warmer months.

The cryptocurrency has struggled to break decisively above the $122,000 resistance level, with softening technical indicators suggesting limited near-term upside potential. However, the long-term outlook remains constructive as U.S. regulatory developments take shape.

The newly proposed GENIUS bill could serve as a catalyst for renewed institutional interest. The legislative package aims to advance blockchain-based finance, digital Treasury bonds, and a potential U.S. digital dollar—signaling growing political acceptance of crypto assets.

Bitcoin Needs to Hit $1.2M to Eclipse Gold's Market Cap

Bitcoin's rally against gold has accelerated, with BTC gaining 40% since April. The cryptocurrency now trades at $115,316, while its market capitalization stands at $2.3 trillion—still a fraction of gold's $22.58 trillion valuation.

For Bitcoin to surpass gold's market cap, each coin would need to reach nearly $1.2 million. This ambitious target reflects BTC's growing correlation with traditional stores of value, despite its volatility.

The stock-to-flow ratio, a key metric for scarcity, shows Bitcoin at 120—double that of gold. This fundamental strength underpins bullish long-term projections, even as short-term price movements remain unpredictable.

Citi Projects Bitcoin to Reach $135K in Base Case, $199K in Bull Scenario by 2025

Citigroup has unveiled updated price targets for Bitcoin, outlining three potential trajectories for 2025. The base case scenario anticipates BTC reaching $135,000 by year-end, while the bullish projection climbs to $199,000. A conservative estimate places the cryptocurrency at $64,000 should macroeconomic conditions deteriorate.

Institutional demand via ETF inflows could contribute approximately $63,000 to Bitcoin's valuation this year alone. The analysis incorporates quantifiable metrics including user growth curves and macroeconomic trends. "ETF demand has become the dominant price driver in 2025," observed Citi's digital assets team, noting unprecedented institutional participation.

The projections arrive amid accelerating adoption of cryptocurrency as a macro hedge. Market structure analysis suggests Bitcoin's correlation with traditional risk assets continues to decline—a trend that could amplify price movements during monetary policy shifts.

Robert Kiyosaki Criticizes ETFs as 'Pictures of a Gun,' Advocates for Physical Gold and Bitcoin

Robert Kiyosaki, author of Rich Dad Poor Dad, has doubled down on his skepticism toward exchange-traded funds (ETFs), dismissing them as inadequate substitutes for tangible assets during economic crises. In a recent post on X, he likened ETFs to "photos of a gun"—useless in moments of real danger—while reaffirming his preference for physical gold, silver, and Bitcoin.

Kiyosaki acknowledges ETFs' convenience for average investors but warns of their limitations. "BEWARE of PAPER," he tweeted, urging individuals to prioritize assets they can hold directly. His critique aligns with his longstanding distrust of fiat currency and financial intermediaries, whom he labels "banksters."

Despite record inflows into gold and crypto ETFs, Kiyosaki’s stance remains unchanged: real wealth lies outside paper promises. The surge in spot Bitcoin ETFs, particularly on exchanges like Coinbase and Binance, hasn’t swayed his conviction that physical ownership is paramount.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption curves, BTCC's Sophia projects:

| Year | Base Case | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $135K | $199K | ETF inflows, halving aftermath |

| 2030 | $400K | $750K | Global reserve asset status |

| 2035 | $1.2M | $2.5M | Gold market cap displacement |

| 2040 | $3M+ | $5M+ | Hyperbitcoinization phase |

"These targets assume 15-20% annualized network growth and decreasing volatility," Sophia clarifies. "The 2025 projection aligns with Citi's model, while long-term targets follow Metcalfe's Law scaling."

border: 1px solid #ddd; border-collapse: collapse; width: 100%;